The rise of e-commerce platforms here in the Philippines also paves the way for the increased usage of mobile wallet systems which are also referred to as e-wallets. In the Philippines, not everyone can easily open a bank account because of the strict requirements when opening a new account, and this is a problem for most Filipinos.

A mobile wallet seems to be the answer to this problem, installing the application and using your mobile number to register you can open your own e-wallet account.

Digital wallet in the Philippines is not new, there are several mobile wallet systems that are used by the public. We will give you a little briefer on some of them so that you can understand how they work and their purpose.

GCash

Let us have a little background of its history is owned and developed by Globe Fintech Innovations which is a joint venture between Ant Group, an affiliate company of the Alibaba Group. It was introduced to the public way back in 2004 but it gained more traction these past few years and due to the COVID-19 pandemic, it becomes more widely adopted by businesses and the public. This mobile wallet system is owned by Globe Telecom which is one of the largest telecom companies in the Philippines.

GCash has a prepaid MasterCard that enables the user to withdraw cash from any ATM all over the country.

Maya

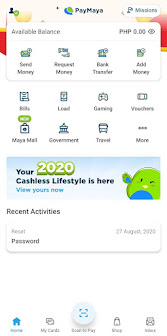

Formerly Smart e-Money inc founded last 2007 is owned by Smart Corporation and is one of the largest telecom companies in the Philippines. Paymaya is an online payment account that has an app where you can load up in convenience stores, pawnshops, and malls and can be used to purchase anything online.

Paymaya goes into rebranding from Paymaya it is now called Maya. They also release Maya prepaid card that you can use to withdraw money from any ATM all over the country. In every successful withdrawal, you will be charged a 15 pesos withdrawal fee.

Coins PH

It started out as a cryptocurrency exchange platform and evolved into a suite of payments services similar to GCash and Paymaya. Coins PH is Co-founded by its CEO Ron Hose the company aims to deliver financial services over the mobile phone to people in South East Asia.

How can I access these mobile wallets?

The three mobile wallet system have their own mobile application. For Android users, you can download the app via Google Play while for iPhone users you can download the app in iOS App Store.

- To create your GCash Account just click this link

- To register your Coins PH Account follow this link

- To make a Paymaya Account just head to this link

Most mobile wallets have a web portal or mobile app to access your account. They are also referred to as digital wallet app or e wallet app. Once you already have an account you can access them via mobile app or access them via their web portal, you just need to enter your credential to access your account.

Web Portal

- GCash - https://m.gcash.com/gcash-login-web/index.html

- Paymaya - https://payout.paymaya.com/

- Coins PH - https://app.coins.ph/welcome/login

GCash Mobile App

After installing the app you just need to register an account. Typically it requires a mobile number to verify your account. Mobile number is also used by mobile wallet to send OTP or MPIN that will serve as security in accessing your account.

Some applications have extra features or perks that require KYC validation. Typically requires a photo of valid identification cards and a selfie photo holding the same identification card. Everything is done using the mobile app itself. When you passed this validation it will unlock some higher credits or features not available to the regular user.

This mobile wallet is capable to do many things like paying monthly bills, payments to stores or malls, and even sending money to anyone with a mobile wallet system.

The two leading e-commerce platforms accept payment via mobile wallets. Lazada accepts payment via GCash and Paymaya while Shoppee accepts payment from GCash and Coins PH.

When it comes to security each has its own ways to protect your wallet. GCash has MPIN that you should never share with anyone. Paymaya has OTP(One Time Password) and additional security called 3D Secure. Coins PH has a password and two-factor authentication to protect your wallet.

Although mobile wallet companies see to it that they put proper security measures and feature to protect their client against hacking and phishing. There are still reported incidents in social media that some still become victim and their money stolen by hackers or cybercriminals. As a precautionary measure, they also set up policies and procedures on how to report hacking incidents in order to block the criminal from withdrawing the money to the account involved.

What are the benefits using an e Wallet?

1. Convenience

Because most of e wallet have mobile app companion you can manage your money from anywhere and at any time, with just a few taps on your smartphone.

2. Security

eWallets use encryption and other security measures to protect your financial information. They also offer two-factor authentication for added security. They require One Time Pin verification that is sent to your mobile phone to increase the security against cybercriminals. Aside from that you don't need to bring big amount of cash making yourself vulnerable from robbery or theft.

3. Speed

With an e wallet the transactions becomes processed instantly, eliminating the wait time associated with traditional banking methods. You don't need to fall in line just to pay your bills or electric utilities, mobile payments become normal for stores and service providers.

4. Accessibility

eWallets becomes a great alternative for people who do not have access to traditional banking facilities, providing them with a secure and convenient way to manage their money.

5. Wide acceptance

Because of the aggressive marketing campaign of eWallets providers. This technology becomes widely accepted by merchants and are a convenient alternative to cash or cards.

In summary:

The e-wallet system is the beginning of the adoption here in the Philippines of a cashless society. In the future, there is also a possibility that there will be more applications that will rise and compete with the existing players in this industry.

In the coming years, these mobile wallets will increase their function and features that would be more beneficial to public consumers. There is also an indication that these mobile wallets will open their own digital bank like Paymaya has already published their intention of opening a bank called Maya Bank this first quarter of 2022.